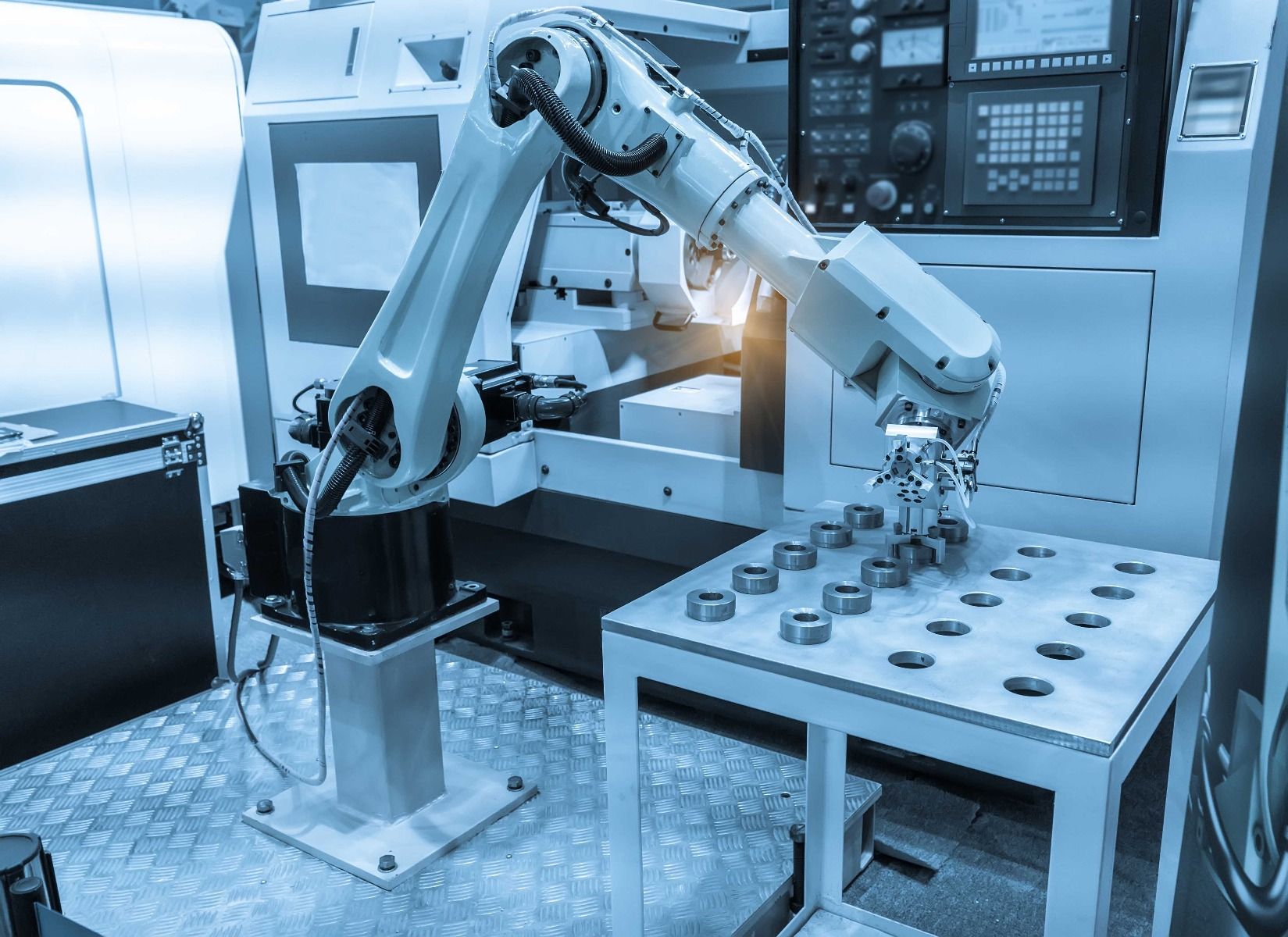

Do You know The Issues of New Structure or the Benefits of Automation? Automating loan origination can be a frightening subject. It’s possible that you’ve heard that the procedure is difficult, and you don’t want to waste your time or money on anything that won’t accomplish your goals. But don’t panic, there are lots of ways to start!

It’s critical to be prepared for anything, even if it means using temporary workers or learning as much as you can about loan software before the holiday season. During the holiday season, you could not have any employees. Automation can be useful if you don’t have any workers over the holiday season.

Read More: Global PS5 Sales by Sony Exceed 30 Million Units

You might choose to handle all of your origination tasks on your own. In this situation, it’s great if you have a process that you follow consistently for each loan file and that works for you.

For instance, if one person is in charge of approving loans while another is in charge of writing them up, each of them should have their own set of files where they can keep all the information pertaining to each application (and not just one place).

By doing this, you’ll avoid having to manually go through every single file when anything like an appraisal or tax return needs attention and will know exactly where those documents need to be looked at! It’s crucial to schedule your duties and time.

While working on numerous projects at once is possible, you need be aware of how much time each activity will take and be able to prioritise accordingly. Additionally, you must be able to work quickly because lending companies need precise loan information by particular due dates.

Explore the Contents

A loan system must be simple to operate.

It need to be simple to use, navigate, and comprehend. Users can achieve this by giving them simple-to-use user interfaces and obvious pathways for exploring the system. The lending tool need to be adaptable to the size or growth of your firm.

Before deciding on a pricing or an implementation schedule for a new loan system, have a look at what is currently on the market to see if there are any features you want to be included in your new programme.

When you’re in a bind, having a borrower on staff might be helpful.

When you’re in a bind, having a borrower on staff might be helpful. You might save time and hassle by having your borrower help with the loan application and documentation. Consider adopting an automated loan software platform that interfaces with your existing systems and processes if you want to benefit from automation.

You shouldn’t be slowed down by or distracted from other tasks by loan software.

Understanding your loan software’s capabilities and how it operates is the greatest approach to make sure that it doesn’t impede your productivity or take your attention away from other tasks. Let’s say you don’t know what the programme does. In that scenario, it won’t assist you achieve your entrepreneurial goals if you don’t grasp how it works and how it fits into the workflow of your business.

Automation technology, like loan software, is the greatest option for every entrepreneur or small business owner who wants to compile their company’s financials fast and effectively without losing critical time! Update your loan origination software, and register for additional training.

- Ensure that the program you are using is the most recent version.

- Get training on how to use the software.

- Sign up for more training in order to keep up with new developments in loan technology and procedures as they become available.