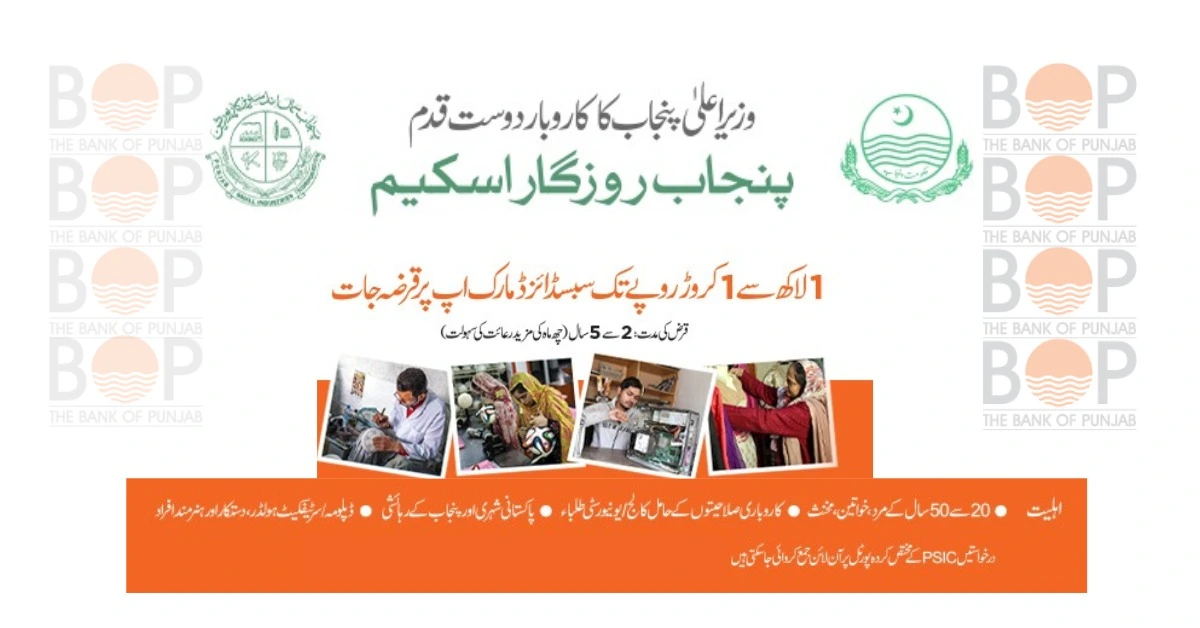

Punjab Rozgar Scheme 2023 – How to Apply for Punjab Rozgar Loan?

The Punjab Rozgar Scheme is a flagship program of the Government of the Punjab. It was designed with a total cost of Rs. 30,000.00 million (Rs. 30 billion) to give discounted loan facilities to micro, small, and medium enterprises (MSMEs) startups as well as existing businesses in partnership with commercial banks. Markup Support and Risk Coverage will be provided by the government of Punjab in order to reduce the cost of commercial loans for MSMEs and to combat the pandemic effect that COVID-19 is having on businesses that are already operating.

The Punjab Rozgar Scheme is a program that has been developed with the goal of providing young people with work opportunities by means of the production of economic activities. Existing firms that have been impacted by COVID-19, as well as university graduates with entrepreneurial skills and diplomas or certificates from technical or vocational training institutes, will be taken into consideration for this opportunity.

Read More: Passive Income Strategies for Pakistanis

Benefits of the Punjab Rozgar Scheme

With a particular emphasis on COVID-19-affected firms, the Punjab Rozgar Scheme will make it easier for new businesses to start-up and established ones to receive financial help in the state of Punjab. The concept places an emphasis on the retail and service industries, as well as manufacturing, agriculture, and livestock.

Micro and other firms who seek to implement resource-efficient and cleaner manufacturing technologies in order to improve their environmental performance will also receive financial support under the Punjab Green Development Program. This support will come in the form of funding.

The scheme aims to empower the unemployed by offering financial assistance, skill training, and resources for startups and businesses. Here are some of the potential benefits of the Punjab Rozgar Scheme:

- Financial Assistance: The scheme often provides loans and financial support to deserving candidates, enabling them to kickstart their own businesses or ventures.

- Skill Development: Training programs associated with the scheme help individuals acquire new skills or enhance existing ones, making them more market-ready.

- Reduced Unemployment: By offering financial aid and skill training, the scheme seeks to reduce the unemployment rate in the state.

- Women Empowerment: Special provisions might be available for women, aiming to promote entrepreneurship and employment among them.

- Support for Marginalized Groups: The scheme often prioritizes marginalized sections of society, ensuring they get ample opportunities for growth and development.

- Encouragement of Entrepreneurship: With financial backing and resources, many individuals are motivated to start their own ventures, promoting entrepreneurship in the state.

- Job Creation: As more individuals start businesses or grow existing ones with the help of the scheme, it leads to the creation of more jobs in the market.

- Economic Growth: When more businesses thrive and the employment rate rises, it positively impacts the state’s economic growth.

- Reduced Migration: By providing opportunities within the state, the scheme might reduce the need for individuals to migrate in search of jobs.

- Holistic Development: The scheme focuses not only on employment but also on skill development and training, ensuring holistic development of individuals.

- Easy Accessibility: The scheme often has an online portal or a dedicated system in place to ensure transparency and easy accessibility for all eligible individuals.

- Low-Interest Rates: If loans are provided under this scheme, they are often at reduced interest rates, making it easier for beneficiaries to repay.

Who can Apply for the Punjab Rozgar Loan Scheme?

- University/College Graduates with entrepreneurial skill

- Diploma/Certificate holder from TVET having technical/vocational training.

- Artisans and skilled workers

- Existing Businesses

(However, preference will be given to existing businesses in the wake of the current COVID-19 pandemic) - Micro and other enterprises that apply for a loan to adopt resource-efficient and cleaner production technologies or any Green / Environment-friendly intervention to improve the environmental performance of their operations.

Eligibility Criteria

The following eligibility criteria will be adhered to to process the loans under the Punjab Rozgar Scheme:

- Age: 20 to 50 years

- Gender: Male / Female / Transgender

- Resident: Citizen of Pakistan, Resident in Punjab, verified through CNIC

- Business Location: Punjab

- Business Type: Sole Proprietor, Partnership, or any business fulfilling other eligibility criteria

- Must have a clean e-CIB / Credit History

- For startups / new businesses

- Having a viable business plan

- For existing businesses

- Having a viable business plan with a focus on sustaining the impact of COVID-19

- Having Valid CNIC

- Any other parameter to be set by Punjab Small Industries Corporation (PSIC) / Government

Schedule of Charges

The schedule of Charges to be paid by the Applicant / Borrower will be as under:

| Application Processing Fee | Rs.2000/- (non-refundable) at the time of submission of application |

| Valuation / legal / documentation charges are inclusive of revenue stamps, Government duties/fee,s etc. | At Actual Rate |

| Insurance ( if applicable) | At Actual Rate |

| Partial / Balloon / Early Settlement Charges | NIL |

| Late Installment Payment Charges

|

Rs. 1 per 1000 per day on the principal amount to be calculated from monthly installment from the due date till the date of actual payment |

Required Documents for the Punjab Rozgar Scheme

You must have scanned copies / clear visible pictures of the following documents ready before you start your application:

- Picture with complete face

- Front-side of CNIC

- Back-side of CNIC

- Latest Educational degree / Certificate, if and whatever applicable (Matric, Intermediate, Bachelor, Master, Ph.D.) etc (if applicable)

- Experience certificate(s) (if applicable)

- License / Registration with Chamber or Trade Body (if applicable)

- Scanned Copy of Security Documents to be offered for availing Loan

You must have the following information handy before you start your application:

- National Tax Number(non-mandatory), In case you don’t have one please register at https://iris.fbr.gov.pk/

- Consumer ID of Electricity bill installed at your current address

- Consumer ID of Electricity bill installed at your current office address (if applicable)

- Registration number of any vehicle registered in your name (if applicable)

- In case of new business an estimate of Monthly business income, business expenses, household expenses, and other income

- In the case of existing business actual Monthly business income, business expenses, household expenses, and other income

- Name, CNIC, and Mobile numbers of Two References other than Blood relative

Read More: Web Development Services in Pakistan: Build Your Online Presence

How to Apply for the Punjab Loan Scheme Online?

- This application shall take at least 15 minutes to complete subject to the availability of the above-listed information/documents.

- You may complete the form in one go or in trenches by saving uploaded sections and submitting it at any time

- After submission of the application, no change/amendment shall be allowed

- Please upload as much information as you have e.g. Financial Statements, Business Feasibility (Download Sample Format), Last 6 months Bank statement, etc. This shall help to better evaluate your application

- Once the form is submitted, your Application Registration Number (ARN) shall appear on the screen and you will also receive an SMS stating the same, please keep it saved

- Please visit the nearest branch of The Bank of Punjab (BOP) along with Application Registration Number (ARN) in order to deposit Processing fee of Rs. 2,000/- after which processing of your application will start

- To find the nearest branch of The Bank of Punjab (BOP), please visit this link (https://www.bop.com.pk/Branch-Network)

- You will receive an SMS once your application moves to the next stage of the process, however, you may check the application status on this Link as well (https://rozgar.psic.punjab.gov.pk)

- New/Fresh applications can only be processed if, the first application is rejected or the first loan is paid off/cleared

FAQs

What is the loan limit?

- Upto Rs. 10.00 Million

- Clean lending: from Rs. 100,000/- to Rs. 1,000,000/-

- Secured lending: from Rs. 1,000,001/- to Rs. 10,000,000/-

What is the purpose of the loan?

- Setting up of new business

- Balancing, Modernization, and Replacement (BM&R) for existing businesses

- Working Capital

What is the MSME sector?

- Manufacturing, Service, Trading, Agriculture, and Live Stock

- (Environment Friendly / Quality Improving Micro Enterprises as defined above will also be considered under the Punjab Green Development Program)

Is there any application processing fee?

Rs. 2000/- (non-refundable) at the time of submission of application

What is the Tenure of Loan / Repayment Period?

From 02 to 05 years including a grace period

What is the grace period?

Up to Six (06) Months (However, the markup will be charged during the grace period)